Click here to read the Important Health Coverage Tax Documents Notice pertaining to 1095C forms.

Medical and Prescription Benefits, and Health Savings Accounts

The university offers two PPO health care plans through Blue Cross Blue Shield of Illinois (www.bcbsil.com) with pharmacy benefits administered by CVS Caremark (www.caremark.com). For 2026 we are continuing with a tiered network approach, with both plan options and all tiers offering a full range of health care benefits. Additional information on each option is below, with details, a plan comparison chart, and fliers regarding the many additional benefits and programs available by clicking on the red headings to expand each section.

The first plan is the Blue Choice Options (BCO) PPO plan. When members utilize the BCO (Tier 1) network, they have a $20 office co-pay for primary care physician visits, $40 co-pay for a specialist visits; the deductible is $750 single / $1,500 family. Those choosing to utilize the broader PPO network (Tier 2) have a $40 office co-pay for primary care physician visits, $80 co-pay for a specialist visits; the deductible is $1,500 single / $3,000 family. After the deductible is met, coinsurance and out of pocket maximums vary by tier. Preventive care is covered at 100%, not subject to co-pays or deductibles. Out of network coverage is also available.

The second option is the Blue Choice Options (BCO) High Deductible Health Plan (HDHP) with a Health Savings Account (HSA). The HDHP utilizes the same Tier 1 and Tier 2 networks as the PPO plan. When enrolled in the HDHP there are no copays, but the member pays all non-preventive medical expenses until meeting the deductible, after which coinsurance applies. For services with Tier 1 providers, the deductible is $1,700 single / $4,500 family. For services with Tier 2 providers, the deductible is $3,000 single / $9,000 family. After the deductible is met, coinsurance and out of pocket maximums vary by tier. Preventive care is covered at 100%, not subject to deductible. Out of network coverage is also available.

A vision discount benefit is included with each plan for no additional premium. This includes an eye exam once every 24 months, with a $200 maximum reimbursement for prescription eye-wear. HDHP members will not receive reimbursement if they have not met their deductible. Please see the IIT Vision Discount Program flier in the Heath Plan Additional Benefits & Programs section below.

For those enrolled in the HDHP and who meet other eligibility requirements, the Health Savings Account (HSA) allows individuals to contribute pre-tax dollars up to the annual IRS maximum. HSAs are set up automatically for HDHP members with HSA Bank (www.hsabank.com). IIT will continue to contribute $500 for Single, $1,000 for 1+1, and $1,500 for Family tiers for 2026, with 1/12 of the annual contribution deposited to members' accounts at the end of each month. If you are 55 or older, you may also make a $1,000 annual catch up contribution. If you are enrolled in Medicare, you cannot contribute to an HSA. When contributing to the HSA, you may also open a limited purpose FSA to pay for dental and vision expenses. The university allows individuals who have elected the HDHP to change their HSA contributions once per month. For additional information, please see the HDHP Pamphlet below under the Forms and Brochures heading.

Proof of relationship and eligibility must be provided to include spouse/dependent children on the plan. A civil union partner meeting eligibility criteria may be covered.

- Dependent children can be covered by your BCBSIL Health Plan up to the last day of the month that they turn 26.

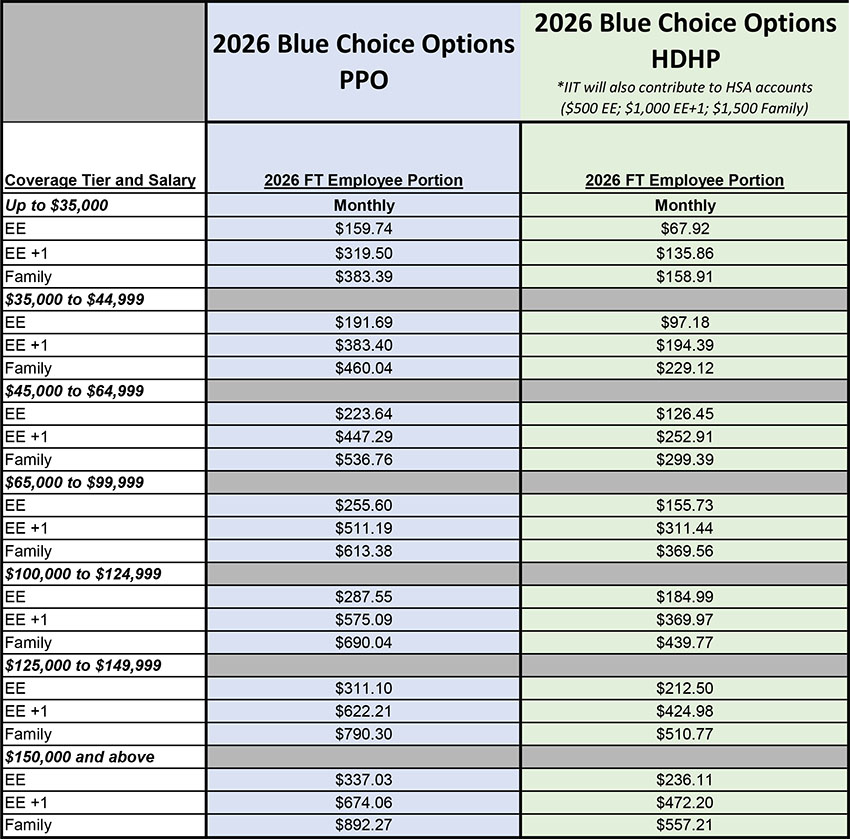

The monthly cost of coverage to the employee is based on income as indicated in the chart below. The university will pay the remainder of the cost.